This article will help you save money and avoid regrets when buying your first home.

Learn how to financially prepare for homeownership, how to calculate what price home you can afford, how to navigate your way through mortgage loans and the closing process, and more.

Find out everything you need to know about first-time home buying so you can enjoy your home, without regrets, for many years to come.

- Are You Ready For Homeownership?

- What Type Of Credit Do You Need To Buy A Home?

- How Much Money Should You Save To Buy A Home?

- The “Are You Ready To Buy A Home” Checklist

- 4 Ways To Dramatically Reduce The Cost Of Your New Home

- How To Buy Your First Home

- Beyond Purchasing Your First Home

Are You Ready For Homeownership?

Buying your first home is an exciting undertaking, one that you’ll remember for a lifetime.

Before you jump in and start shopping for homes, though, it’s important to understand how the process works and how much money it really costs to purchase, and own, a home.

Once you understand how the process works and how much everything costs, you’ll be ready to determine when would be the best time for you to buy your first home.

In this section, we’ll help you determine whether you’re financially ready to purchase a home by guiding you through the following questions:

- Why do I want to buy a home?

- Am I financially prepared to buy a home?

- What are the hidden expenses of homeownership?

- What is the full list of expenses involved in buying a home?

- Is my credit rating strong enough to buy a home?

You’ll also discover tips on how to budget and save for your first home, so you’re 100% ready when the time comes.

Why Do You Want To Buy A Home?

Many people buy a home because they think it’s the “normal” thing to do. They see their friends buying homes, and many times — simply want to keep up with the crowd.

Purchasing a home is a serious financial step, and if you’re not ready for it, you shouldn’t be swayed by peer pressure or the need to fit into “normal.”

A survey published by Highland Solutions toward the end of 2020 revealed some interesting information about today’s “normal” finances:

- The majority of people (63%) have been living paycheck-to-paycheck since the spring of 2020.

- The majority of people (67%) regret not having saved more money prior to 2020.

- The overwhelming majority (82%) of people say they could not afford a $500 emergency if they encountered one.

- Nearly half of the people surveyed (44%) say they were already living beyond their means before the pandemic hit.

If you’re thinking about buying a home because it’s the “normal” thing to do, or because the majority of your friends are doing it, you should reconsider.

The majority of millennials (people ages 25-40) homeowners regret their home buying choices, according to a 2021 survey by Bankrate.

Of the 64% of millennials that regret their home-buying decisions, 68% of them cite financial reasons for their remorse, including:

- High maintenance and homeowner-related costs (21%)

- Not happy with their mortgage rate (12%)

- Mortgage payment is too high (13%)

- Feel they paid too much for their home (13%)

- Say their home was not a good investment (9%)

The good news is that all of these financial regrets can be avoided by understanding the costs and process in advance.

Normal people end up broke.

Normal millennials have regrets after purchasing their homes.

The majority of people end up broke, stressed, and remorseful when it comes to their finances and their homes.

Instead of looking to the majority for your idea of “normal,” think like the minority.

The minority of people will research home-buying costs, processes, and homeowner expenses before they determine when and what to purchase.

The minority of people might wait a bit longer to buy their first home, but when they do, they’ll know their finances can handle it.

The minority will move forward with the confidence that they can afford their home because they’ve taken the time to educate themselves about the process and expenses before jumping in.

Are You Financially Prepared To Buy A Home?

In this section, we’ll show you navigate and financially prepare for your first home purchase by answering questions such as:

- How much does it cost to buy a home?

- How can you prepare for the hidden costs of homeownership?

- How much mortgage can you afford?

- How much money should you save before you buy a home?

- How can you slash the price of your home?

- What type of credit do you need to buy a home?

How Much Does It Cost To Buy A Home?

It’s easy to underestimate the costs involved in purchasing a home because there are several you rarely hear about.

In addition to a downpayment, you’ll also need to be prepared to pay closing costs, reserves, insurance and taxes, and survey-appraisal-inspection fees.

Let’s take a look at each of these costs and find out how you can prepare for them.

Downpayment: 20% Of Purchase Price

The downpayment is the amount of cash you put down on your home and is not covered by your mortgage loan.

For many people, saving for the downpayment on a home is the toughest financial challenge of the entire process.

Your mortgage lender probably won’t require a 20% downpayment. In fact, many only require 2-3% of the purchase price.

Your banker will probably jump through hoops to get you in with the lowest down payment possible — because they make more money (and commissions) when you save less and borrow more.

For example, if you’re purchasing a $200,000 home and you make a 3% down payment of $6,000 instead of a 20% downpayment of $40,000, your lender pockets an extra $18,000 over the lifetime of your mortgage.

Putting less than 20% down on a home is a costly mistake that may cause you to regret your purchase for many years.

When you put less than 20% down on a home, here’s what happens:

- You have to pay for your banker’s private mortgage insurance (PMI), which costs between .5% – 2% of the purchase price every year. PMI is insurance that covers your banker if you default on the loan, but it has no benefits to you, the borrower.

For example, you’d pay about $285 per month extra (in addition to your regular mortgage payment) for private mortgage insurance on an average-priced ($285,000) home.You’ll pay for your banker’s PMI until you have at least 20% equity in your home, at which point you can request to get it dropped. By law, the lender isn’t required to drop your PMI until you’ve got 22% equity in your home.

Equity is your mortgage amount vs what the home is actually worth. So, if you buy a home for $200,000, and you need to take out a $150,000 mortgage loan, that means you’ll have $50,000 equity in your home. Even when you reach the required equity, getting the PMI removed from your mortgage can be a hassle that requires paperwork, a new appraisal, and often months of waiting.

- You have to borrow more money to purchase your home, which can end up being A LOT more expensive than you might imagine.For example, if you buy a $200,000 home with a 2% downpayment ($4,000) instead of a 20% downpayment ($40,000) on a 30-year mortgage, that home will end up costing you about $400,000 over the lifetime of your loan.Interest, fees, and closing costs are all higher when you skimp on the down payment

For people who think like the minority, a 20% downpayment presents an opportunity to save a small fortune when purchasing a home. Not only can you skip the PMI costs, but you’ll also save thousands on interest over time.

Closing Costs: 1.5% – 2.5% Of Total Purchase Price

When you sign for your mortgage loan, there are additional costs and fees that aren’t covered by your down payment. These closing costs, which are usually split between you and the seller, add to the total of 2% – 5% of the purchase price of your home. Count on your half of the closing costs totaling 1.5% – 2.5% of the purchase price.

Closing costs cover things like application fees, title acquisition, any escrow charges that cover insurance or property taxes, and real estate agent commissions. “Closing costs” is an umbrella term that covers a variety of expenses in real estate transactions. The actual charges vary by state.

However, you cannot avoid closing costs although, as they are a necessary part of every real estate transaction.

For example, if you’re buying a $250,000 home, you’ll probably pay between $5,000 – $12,500 in closing costs. Many lenders offer to roll your closing costs into your mortgage loan, but then you’ll have to pay interest on those costs. If you understand finances, you’ll try to pay your closing costs up front because it’s another excellent opportunity to save money on the total cost of your home.

Reserves: Equal To Two Mortgage Payments

Most lenders require you to have enough cash in the bank (called “reserves”) to cover at least two months (or more) of mortgage payments.

However, we strongly recommend that you don’t purchase a home before you bank at least six months of living expenses.

A full savings account equal to six months of living expenses is critical to ensuring that you don’t fall behind on your mortgage payments if you suddenly lose your income, run up against emergency home repairs, or experience any other type of financial emergency.

How Much Does It Cost To Buy A Home?

It’s easy to underestimate the costs involved in purchasing a home because there are several you rarely hear about.

In addition to a downpayment, you’ll also need to be prepared to pay closing costs, reserves, insurance and taxes, and survey-appraisal-inspection fees.

Let’s take a look at each of these costs and find out how you can prepare for them.

Downpayment: 20% Of Purchase Price

The downpayment is the amount of cash you put down on your home and is not covered by your mortgage loan.

For many people, saving for the downpayment on a home is the toughest financial challenge of the entire process.

Your mortgage lender probably won’t require a 20% downpayment. In fact, many only require 2-3% of the purchase price.

Your banker will probably jump through hoops to get you in with the lowest down payment possible — because they make more money (and commissions) when you save less and borrow more.

For example, if you’re purchasing a $200,000 home and you make a 3% down payment of $6,000 instead of a 20% downpayment of $40,000, your lender pockets an extra $18,000 over the lifetime of your mortgage.

Putting less than 20% down on a home is a costly mistake that may cause you to regret your purchase for many years.

When you put less than 20% down on a home, here’s what happens:

- You have to pay for your banker’s private mortgage insurance (PMI), which costs between .5% – 2% of the purchase price every year. PMI is insurance that covers your banker if you default on the loan, but it has no benefits to you, the borrower.

For example, you’d pay about $285 per month extra (in addition to your regular mortgage payment) for private mortgage insurance on an average-priced ($285,000) home.You’ll pay for your banker’s PMI until you have at least 20% equity in your home, at which point you can request to get it dropped. By law, the lender isn’t required to drop your PMI until you’ve got 22% equity in your home.

Equity is your mortgage amount vs what the home is actually worth. So, if you buy a home for $200,000, and you need to take out a $150,000 mortgage loan, that means you’ll have $50,000 equity in your home. Even when you reach the required equity, getting the PMI removed from your mortgage can be a hassle that requires paperwork, a new appraisal, and often months of waiting.

- You have to borrow more money to purchase your home, which can end up being A LOT more expensive than you might imagine.For example, if you buy a $200,000 home with a 2% downpayment ($4,000) instead of a 20% downpayment ($40,000) on a 30-year mortgage, that home will end up costing you about $400,000 over the lifetime of your loan.Interest, fees, and closing costs are all higher when you skimp on the down payment

For people who think like the minority, a 20% downpayment presents an opportunity to save a small fortune when purchasing a home. Not only can you skip the PMI costs, but you’ll also save thousands on interest over time.

Closing Costs: 1.5% – 2.5% Of Total Purchase Price

When you sign for your mortgage loan, there are additional costs and fees that aren’t covered by your down payment. These closing costs, which are usually split between you and the seller, add to the total of 2% – 5% of the purchase price of your home. Count on your half of the closing costs totaling 1.5% – 2.5% of the purchase price.

Closing costs cover things like application fees, title acquisition, any escrow charges that cover insurance or property taxes, and real estate agent commissions. “Closing costs” is an umbrella term that covers a variety of expenses in real estate transactions. The actual charges vary by state.

However, you cannot avoid closing costs although, as they are a necessary part of every real estate transaction.

For example, if you’re buying a $250,000 home, you’ll probably pay between $5,000 – $12,500 in closing costs. Many lenders offer to roll your closing costs into your mortgage loan, but then you’ll have to pay interest on those costs. If you understand finances, you’ll try to pay your closing costs up front because it’s another excellent opportunity to save money on the total cost of your home.

Reserves: Equal To Two Mortgage Payments

Most lenders require you to have enough cash in the bank (called “reserves”) to cover at least two months (or more) of mortgage payments.

However, we strongly recommend that you don’t purchase a home before you bank at least six months of living expenses.

A full savings account equal to six months of living expenses is critical to ensuring that you don’t fall behind on your mortgage payments if you suddenly lose your income, run up against emergency home repairs, or experience any other type of financial emergency.

Homeowners Insurance and Property Taxes: Varies

Most monthly mortgage premiums will include property taxes and home insurance.

However, your banker may require you to pay for one year’s worth of property taxes and homeowners insurance and possibly six month’s of property taxes — in advance (at the time of closing). Your lender then deposits this tax and insurance money into an escrow account and pays it on your behalf when due.

- Homeowners insurance is mandatory if you’re paying for your home with a loan. It costs an average of $1,200 per year and helps ensure that you won’t lose money or your home to events such as fire, lightning, or vandalism. The price of homeowners insurance varies depending on the policy you choose and the value of your home and property.

- Property taxes are taxes you pay on your home and property and are typically paid on a once-or-twice per year schedule. How much you pay for property taxes depends on the value of your property and your local tax rates.The average U.S. homeowner pays about $2,375 per year in property taxes, however, in some states the rates are twice as high.

Survey, Appraisal, And Inspection Fees: $600 – $2000

You’ll most likely pay out about $300 – $1500 in survey and appraisal fees (depending on the value of your home) and another $300 – $500 for private home inspection fees when purchasing a home.

These fees vary depending on what state you live in and what type of inspections you request.

- A property survey verifies the boundary lines and legal description of the property your house sits on. In some cases, a property survey may not be required (depending on where you live and what lender you use). However, a property survey is an essential step in home buying and one you shouldn’t skip even if you’re not legally required. Getting a clear understanding of your property lines is critical to know where you and your surrounding neighbors can and can’t build, garden, fence, or pave.Property surveys cost an average of $400 – $700, however, you may pay more for larger properties or certain terrains or locations.

- A home appraisal is when an unbiased, professional appraiser evaluates the home you’re about to buy, taking into consideration:When you put in a bid on a home and come to a price agreement with the seller, you then have to get the home’s worth evaluated by a professional, unbiased appraiser. This step protects the lender since the home serves as collateral for the loan.Appraisers work for the lender, but you reimburse them for the fee (usually $300 – $400) as part of the closing costs.Appraisers take the following into consideration when determining the value of your home:

- Location

- Square footage

- Condition

- Additions and renovations

- Real estate value of the neighborhood

If the appraiser evaluates your home for less than the selling price, your lender will not cover the overage in the mortgage loan. For example, if you and the seller agree on a price of $200,000, but the appraisal evaluates its worth at $190,000, your bank will only give you a loan for $190,000.In this case, you can renegotiate with the seller, pull the offer and get your money returned, pay for the difference in cash, or challenge the appraisal.

- A home inspection typically costs between $300 and $1,000, and it ensures that you get what you think you’re paying for. When you put an offer in on a home, it’s wise to negotiate a 7-day contingency that allows you to hire a private inspector who will determine whether there are any problems with the home.

For example, you may not realize that your home is prone to flooding, and end up paying $20,000 in repairs only months after you move in.Even newly-built homes can have problems such as holes in the roof, improperly installed floors and staircases, or poor construction that makes the home unsafe.

Keep in mind that just because the home looks nice and problem free on the surface, there might be some major issues going on below the floor or behind the walls.

Only a professional inspector can check these areas and show you what’s really going on.With an inspection contingency, you can discover problems before you buy and work the price of repairs into your negotiations.

Hire your own property inspector, instead of taking the referral your real estate agent gives you. An agent’s goal is to close on the home, which is a conflict of interest for the buyer who wants to thoroughly inspect it first.To find a legitimate home inspector (there are many scammers), check out organizations such as the American Society of Home Inspectors, International Association of Certified Home Inspectors, or the National Academy of Building Inspection Engineers.

When you purchase a home, you should be prepared to pay for more than the down payment. In addition to a downpayment, you’ll also need to pay closing costs, reserves, taxes and homeowners insurance, and survey/appraisal/inspection fees.

How Much Does It Cost To Own A Home?

Have you ever thought, “Hmm, I’m paying $1,000 in monthly rent — at that price, I could be making monthly mortgage payments on my own home instead!”?

That line of thinking can get people in deep financial trouble, since owning a home involves so much more than monthly mortgage payments.

Homeowners’ insurance, property taxes, maintenance, utilities, association fees, and seasonal services all contribute to the overall price of owning a home.

If you’re not prepared for the additional costs and don’t budget for them in advance, you might discover that owning a home is hardly the ideal you dreamed of.

64% of millennials say they have home-buying regrets,and 21% of those say high maintenance fees and homeownership costs are the reason for their remorse.

In this section, we take a look at some of the costs associated with owning a home, so you can prepare ahead of time and avoid regrets.

Mortgage Payments, Homeowner Insurance, And Property Taxes

Home mortgage, insurance, and taxes are often lumped into one category because they’re typically combined into one monthly payment (especially during the first few years).

In most cases, you’ll make one monthly payment (that includes mortgage, insurance, and taxes) to an escrow company that will turn around and make individual payments for you. This makes it easier on you when writing out the bills each month, and also satisfies your lender, who needs a guarantee that your insurance and taxes are paid on time.

Mortgage payments are the price you negotiate with your lender when you take out the mortgage loan.

Mortgage payments include:

- Principal: the amount of money you borrowed from the lender

- Interest: the cost of your loan, based on a percentage amount of your loan

Every dollar you finance through the bank is a dollar you have to pay interest on, and the interest on your mortgage loan always costs more than it seems.

For example, if you only put a 2% downpayment on your home, you can end up paying $200,000 in interest on a $200,000 home with a 30-year fixed mortgage.

That’s why financial preparation is critical when purchasing a home. To reduce the overall cost (interest) of your mortgage:

- Make a downpayment of at least 20%.

- Build a high credit score so you can get lower interest rates.

- Pay more than the required minimum mortgage payments. The quicker you pay off your mortgage loan, the less it costs you in interest.

Homeowners insurance is a kind of insurance that protects your home and property, including your appliances and possessions, and also protects you from lawsuits if someone gets hurt on your property.

If someone or something damages your home, property, or possessions, homeowners insurance is the only way to recover your financial loss.

Homeowners insurance is not required by law.

However, if you take out a mortgage loan, your lender will require you to have homeowners insurance.

Regardless of cost or requirements, all homeowners need a good homeowner insurance policy. Without it, if a storm or fire destroys your home, you could end up homeless while still owing hundreds of thousands of dollars on your mortgage loan.

If you are buying a home or already own one, insurance is a must — whether or not it’s required by a lender or the law.

Did you know? Nearly 50% of Americans live in earthquake-prone areas and 90% of Americans live in areas considered “seismically active.”

When purchasing a homeowners insurance policy, you should take out enough insurance to cover the cost of rebuilding your home, in case a fire or storm destroys it.

The average U.S. homeowners insurance policy is about $1,200 per year, but don’t count on yours being that low.

There are several factors that can increase or decrease the cost of your insurance, including:

- Where you live: For example, Oklahoma homeowners pay an average $4,445 per year, while Vermont residents pay only $600 – $650.

- What size deductible you set

- How many discounts you can claim

- The location and age of your home

- Whether you need to add additional coverage to protect against situations that aren’t covered in typical policies, such as earthquake, flooding, or sewage backup. If you own high-priced artwork, jewelry, or other possessions, you may also need additional coverage.

The cost of homeowners insurance can vary by extremes depending on several factors, so take a couple minutes to get insurance quotes or learn the average cost in your area before you buy a home.

Property taxes help fund your community by paying for schools, first responders, water, sewage, infrastructure, and more.

Property tax costs differ from one country to another, and you may even be required to pay both city and county taxes, depending on where you live. Averages across the U.S. range from .018% to 1.89% of your home’s assessed value.

When budgeting for a home, keep in mind that the cost of property taxes and homeowners insurance can rise over time.

Maintenance Costs

Maintaining your homes’ safety and functionality requires that you continually invest in repairs, upgrades, and (eventually) renovations.

In a typical year, the average homeowner spends $9,081 on household projects, according to a report by HomeAdvisor.

However, due in part to rising labor and supply costs, homeowners spent an average of $13,138 on improvement, maintenance, and repairs in 2020.

Home repairs don’t always happen on a predictable schedule, so you want to set aside some money every month for repairs.

How much you need to invest will depend on the age and quality of construction of your home, plus the cost of materials and labor in your area.

According to John Ghent, president-elect of the American Society of Home Inspectors, here’s how much you should plan to spend the following on home repairs and maintenance:

- Homes ten years and younger: .75% of its value annually

- Homes ten-twenty years old: 1.5% of the home’s value

- Homes twenty-thirty years old: 1% – 3% of the home’s value

For example, if you live in a $200,000 house that’s 25 years old, you should budget at least $3,000 per year on home repairs, upgrades, and improvements.

When that home reaches 30 years of age, you would budget $6,000 per year.

However, the Homeadvisor report mentioned above shows that people probably spend a bit more on their homes than Ghent recommends saving.

Utilities

If you’re used to living in an apartment, dorm, or your parents’ house, then you’ll want to do a bit of research to find out what utilities might cost for the type of home you’re looking for.

One report, by Inspire Clean Energy, recommends that homeowners set aside about $275 per month for basic utilities such as:

- Electric ($118)

- Gas ($72)

- Water ($70)

- Trash/recycling ($14)

Keep in mind that you’ll also want to include internet and cable in your utility bills, which typically run about $50 – $300 per month, depending on where you live and what package you choose.

If you live in an area with extreme weather (hot or cold), utilities will cost more.

It’s not unusual to receive a $400 monthly bill for electricity alone during extremely cold winters, and running air conditioning in high heat can get nearly as expensive.

If you buy a large home, utilities will cost more.

The average size of a home in the U.S. is roughly between 2,300 – 2,500 square feet, and if you purchase a larger home you should expect to pay more for utilities.

On a 4,000 square-foot home, the average electric cost alone is about $200 – $300 per month in most states. Over 4,000 square feet, you should add about $5 – $7 in electric costs for every 100 square feet.

Also keep in mind that larger homes carry more hidden costs, including (for most) landscaping, housekeeping, pool cleaning, club memberships, security, and more.

Homeowner Or Condo Association Fees

Homeowner or condo association fees may or may not be required, depending on whether your future home is part of an association.

Be warned that many homeowner and condo associations have clauses that allow them to raise the monthly fees when needed.

So, what seems like a reasonable $200 monthly fee when you purchase the home could end up costing you $400 a month if you’re not careful about the contract.

In addition, if you want to make certain upgrades or changes to your property or home, the association will have to approve it first. They’re typically very specific about what you can change, which can make it very difficult to shop around and find the best price for a new fence or other landscaping.

The HOA may just set the price & building material for a specific project, so if you’re not ready to take on a certain project at their price point, you may want to consider moving to another neighborhood without an HOA or fee.

However, an HOA may sometimes take care of some property maintenance and minor indoor repains, which could save you money over time. Be sure to look into whether these conveniences are worth the price tag before you move into an HOA community.

Seasonal Services

Landscaping, snow removal, pool fees, and house cleaning costs may also factor into your home expenses.

If you live in an HOA community, some of these services may be covered. However, you’ll have to cover these expenses yourself if you live in a traditional neighborhood.

How Much Money Should You Spend On A Home?

13% of millennials with homeowner regrets say their mortgage payments are too high.

How do you know how much to spend on a home so that you don’t regret your mortgage payments later?

Remember, your home costs money to buy and maintain:

- Closing costs + interest on closing costs if you fold them into the mortgage loan

- Your mortgage loan + interest on your mortgage loan

- Private mortgage insurance (if your down payment is less than $20,000)

- Home insurance

- Property taxes

- Maintenance, repairs, and improvements

- Utilities

Many personal finance experts recommend keeping your mortgage payments to no more than one-third of your gross income, but we at Minority Mindset think that’s a recipe for disaster.

Monthly Mortgage Payments Should Not Exceed 27% Of Your Net Income

To ensure that you can keep control of your other monthly expenses, we recommend not allowing your mortgage payments to exceed 27% of your monthly net income.

For example, if you and your spouse each take home $3,000 per month (total of $6,000 per month), you would limit your monthly mortgage payments to no more than $1,500 per month.

And, if you have children in your future and one parent will stay home for a few years, be sure to budget based on one person’s income, not two.

To ensure that you can afford your mortgage payments, along with all the other costs of homeownership, keep your monthly mortgage payments to less than 27% of your monthly take-home pay.

How To Allocate Your Income As A Homeowner

By planning your homeowner budget before you begin shopping, you’ll save yourself a lot of stress and anxiety.

Planning ahead will help you make a better decision on which home to buy, and allow you to enjoy the process of buying your first home.

Minority Mindset recommends allocating your homeowner budget with the 75/25 method:

- 75% of your net income toward spending

- 25% of your net income toward investing.

If for some reason, you don’t have a full six months of living expenses in your emergency savings account, then the 75/25 allocation would change to 75/15/10:

- 75% of your net income toward spending

- 15% of your net toward savings

- 10% of your net income toward investing

The spending category is where the bulk of your income goes, and you want to make sure that you don’t allow it to exceed 75% of your net income.

Be sure to include the following in the spending portion of your budgeting:

- Food

- Clothes

- Utilities

- Monthly mortgage payments

- All insurances: health, car, homeowners, pet

- All medical expenses, including prescriptions

- Debt payments (such as loans and credit cards)

- Snow removal and lawn care

- Trash pickup

- Home maintenance and repairs

- Entertainment

Investing is an essential part of any monthly budget, so you also want to be sure that you can afford to allocate 25% of your income toward investing each month.

By allocating your income with the 75/25 method, you can plan for a financially stable future that helps you smoothly manage the expenses related to owning a home.

What Type Of Credit Do You Need To Buy A Home?

Credit scores in 2021 are more important than ever before.

Today, your credit scores are checked for almost everything, including basics such as rental apartments, employment, cell phone plans, and insurance rates.

How Credit Scores Affect Home Buying

Not only do you need a certain credit rating to qualify for a mortgage loan, but the strength of your credit will also affect the cost of your mortgage loan and homeowners insurance policy.

You might qualify for a mortgage loan if you have poor credit, however, your mortgage payments will be much higher than someone with good credit.

For example, if you have bad credit and end up with a 4.5% interest rate on a $300,000, 30-year mortgage loan, you pay $173 more each month than someone with good credit who gets a 3.5% interest rate.

Over time, the costs of poor credit are nearly unimaginable.

For the $300,000 home with the higher 4.5% interest rate, you end up paying $62,252 more (over the lifetime of your loan) for your home than someone with a 3.5% interest rate.

- In the example above, the homeowner pays $173 more each month for a total of $62,252 more over the lifetime of their loan — due to poor credit.

Before you consider purchasing a home, it may be worth your time and effort to strengthen your credit rating before applying for a mortgage loan.

You can usually improve your credit within 5 – 6 months, but if it takes longer, it’s worth the wait. you’ll save a great deal of money on your monthly mortgage payments and the overall cost of your home loan.

How Do Credit Ratings Work?

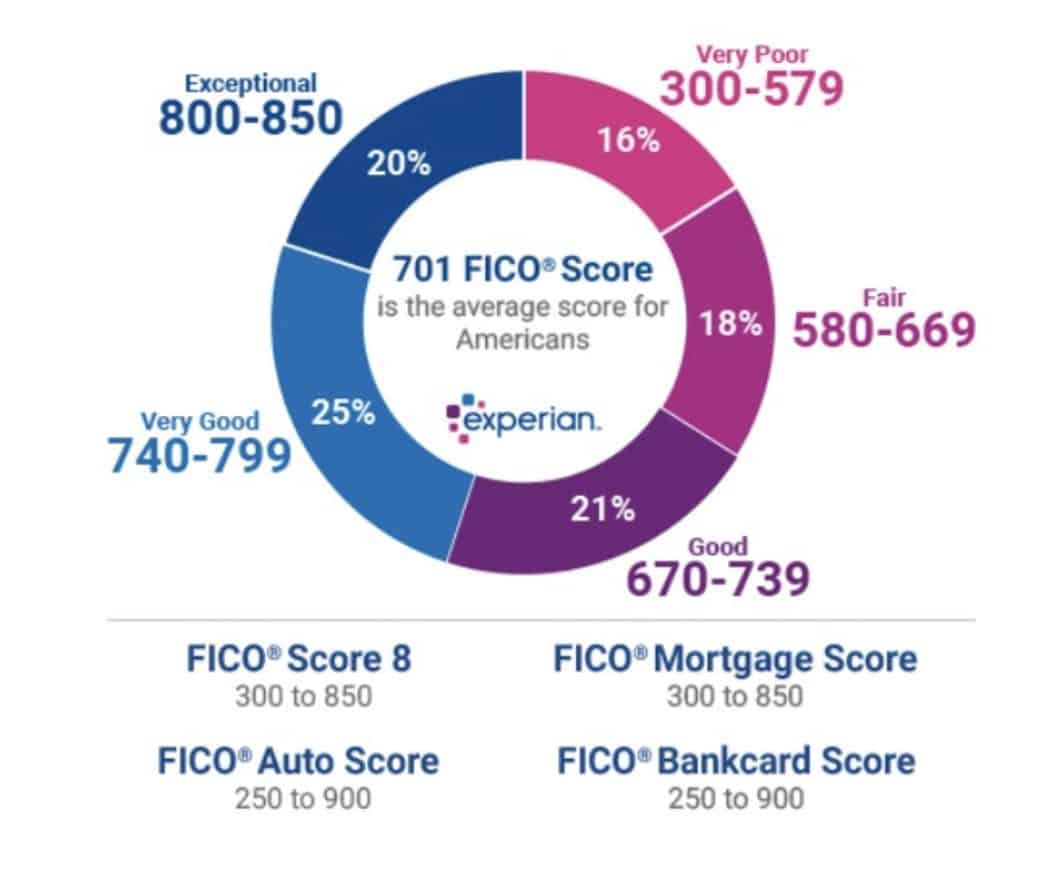

Most banking institutions use the FICO credit score system to rate your credit.

FICO assigns a 3-digit number to represent how trustable they think you are when it comes to borrowing money and paying your bills on time.

Here’s what FICO scores represent:

According to a report by Experian, here’s what your FICO score means:

- 300 – 579 FICO score: Very Poor, you probably won’t get approved for any type of credit.16% of Americans fall into the “Very Poor” credit category.

- 580 – 669 FICO score: Fair, you’re considered a “subprime” borrower — if you can get approved for any credit, your interest rates will be very high. 18% of Americans fall into the “Fair” category.

- 670 – 739 FICO score: Good, lenders consider you “trustable” and you’re likely to get average interest rates on credit. Only 8% of people with “good” credit scores fall seriously behind on payments.

- 740 – 799 FICO score: Very Good, you’ll enjoy lower interest rates on loans and qualify for better credit cards.

- 800 – 850 FICO score: Exceptional, you’ve reached the top credit tier and are granted the lowest interest rates. You’re likely to get approved in most credit situations.

To determine your credit score, FICO uses five separate criteria.

To determine your credit score, FICO uses five separate criteria.

1. Payment history: 35%

Payment history is a significant factor in determining your credit rating, as it accounts for 35% of your credit score.

One or two late payments may not destroy your credit if you normally pay on time. However, if you have a history of late or non-payment, you’ll have a difficult time building a good credit score.

A perfect payment history will help to raise your credit score, however, it won’t give you a perfect credit score.

The amount of money you owe, length of your credit history, amount of new credit you’ve applied for or received, and the combination of credits types you use are also determining factors of your FICO score.

The types of credit that factor into your score include:

- Credit cards and retail credit

- Installment loans

- Any finance company accounts

- Mortgage loans

- Public records and collection items

2. How much money you currently owe: 30%

How much you currently owe to creditors accounts for 30% of your FICO credit score.

Owing money can be a positive, but if you’re using most of your available credit or otherwise give the impression that you’re financially overextended, you may get pegged as an at-risk borrower.

3. Length of your credit history: 15%

The length of your credit history accounts for 15% of your credit score.

A long credit history isn’t required for a good score, but it can help.

Fico scores consider the following when determining your score:

- The age of your oldest account, newest account, and average age of all accounts

- How long it’s been since you used your accounts

4. New credit: 10%

The amount of new credit you’ve applied for or received has a 10% influence on your credit score.

If you’ve opened several new accounts in a short time period, especially if you have a short credit history, it can get you flagged as a high-risk borrower.

5. Credit mix: 10%

The different types of credit you currently use play a 10% role in your credit score.

Having a balance of credit types that are successfully managed (with good payment histories) can boost your credit score because it shows that you can handle payments.

For example, a healthy balance of installment accounts (such as auto and student loans) combined with revolving accounts (such as credit, gas station, and retail store cards) may help boost your credit score.

Of course, the above only improves your credit score if your payment history with each account is good. If yours show late or missing payments, then it may harm your credit score.

Focusing on the above five factors can help improve your credit score.

If you’re able to get your score in the “Very Good” or “Exceptional” category, you’ll get a better interest rate on your mortgage loan and save a lot of money.

An excellent credit rating will save you a small fortune on the overall cost of your home.

What Credit Score Do You Need To Buy A Home?

Credit score requirements vary by lender, but most require a minimum credit score of 620 to get a mortgage.

However, you should aim for a minimum 740 credit score before you buy a home, so you get a decent interest rate on the mortgage loan.

Instead of rushing into homebuying, we recommend you take the time to improve your credit score until it reaches at least 740.

How To Improve Your Credit Score For Home Buying

If you have very poor or no credit, here are nine tips to help you start building a better credit score:

- Pay off all your debt. If you have a lot of debt, consider picking up extra work to help pay it off more quickly.

- Use credit cards responsibly, paying off the balance in full at the end of each month.

- Keep all your payments and bills current — always.

- Apply for new credit only as needed, and don’t apply for multiple new accounts at once.

- Don’t close any credit card accounts unless they’re costing you money, because multiple accounts can help boost your credit rating.

- Check your credit reports for errors and work to get them removed.

- Use secured loans, secured credit cards, and other credit builders such as passbook loans, if you have no credit at all.

- Check out non-profit lending circles to obtain loans that can strengthen your credit score. For example, the Mission Asset Fund offers affordable loans that can help build your credit rating.

- Get credit for your on-time utility, cell phone, and rental payments through services such as Experian Boost and Rental Kharma.

You can probably improve your credit rating within 5 – 6 months, however, if it takes longer, it’s well worth the time. A good credit rating improves the quality of your financial life in several ways, including lowering your mortgage costs.

How Much Money Should You Save To Buy A Home?

Before you begin shopping for a home, check that your finances are in order and that you’ve got enough money saved up to prepare for homeownership

1. Emergency Savings Account: Equal To Six Months Of Living Expenses

The first financial step toward homebuying is to ensure that you’ve got a full emergency savings account, equal to six months of living expenses, in the bank.

Unexpected life events are normal, and they happen to everyone at some point.

You could suddenly lose your income, incur hefty medical expenses, or have to replace or repair your car.

Financial emergencies typically require quick cash, which is why a bank is the best place to store your savings account.

A savings account doesn’t ask questions when you need to withdraw money, and won’t charge you fees or penalties for early removal, the way that many investments do.

Building an emergency savings account equal to six months of living expenses will help ensure you against most of life’s financial emergencies.

It will also nearly guarantee that you can make your mortgage, homeowners insurance, and property tax payments on time so that you don’t have to fear losing your home due to an unexpected life event.

Your monthly expenses as a homeowner will be higher than what you’re probably used to. You’ll want to base your savings requirement on your monthly budget as a homeowner

Homeownership requires you to set aside money each month for repairs and maintenance, higher utility bills, landscaping, and other homeowner costs.

When calculating how much you need to save, figure six months of living expenses in your new home — not six months of expenses on the scaled-back budget you’re probably living on right now.

A full emergency savings account will help protect you and your family from any financial crisis that could threaten the well-being of your home and family.

2. Home Buying Costs: 2% – 5% Of Purchase Price

In addition to a full emergency savings account, you also want to save up enough money to cover your closing costs so you don’t have to fold them into your mortgage loan.

Piling your closing costs into your mortgage loan means that your monthly payments will be higher and you’ll pay more for the loan itself.

- Here’s a quick recap of the expenses you’ll need when you buy your home:

- Down payment: 20% of purchase price

- Closing Costs: 1.5% – 2.5% Of Total Purchase Price

- Reserves: Equal To Two Mortgage Payments (you can use your emergency savings for this)

- Additional Expenses (survey, appraisal, and inspection fees): $600 – $2000

- Home insurance and property taxes: Equal to six months of taxes and insurance

Before you begin shopping for homes, make sure that you have an emergency savings account equal to six months of (homeowner) living expenses, plus the estimated closing costs, saved and sitting in your bank.

The “Are You Ready To Buy A Home” Checklist

Sixty-four percent of millennials regret their home buying choices, and we want to make sure that you don’t fall into that category.

This checklist will help you avoid the problems that cause most millennials to regret their decisions.

_____ Are you aware of the costs involved in purchasing a home?

Buying a home costs money, including a downpayment, interest on the mortgage loan, and closing costs.

_____ Do you have enough money saved?

_____ Do you have six months of homeowner living expenses in your savings

Account?

_____ Do you have a 20% cash down payment saved?

_____ Do you have enough money saved to cover closing costs?

_____ Can you afford the new monthly mortgage payments?

_____ Are your mortgage payments less than 25% of your net monthly income?

_____ Does your total monthly spending budget (including mortgage and homeowner

expenses) cost less than 75% of your monthly net income?

_____ Do you consider your home an investment?

A home is not an investment. If you think of your home as an investment, you’ll likely be disappointed. There’s no guarantee that you will be able to sell it for a profit — or even at market value. You’ll put time, energy, and money into it over time. Owning a home rewards you with countless benefits, however, it should not be considered an investment.

_____ Do you know what size house you want?

Be clear on your square footage minimum and maximum before you buy, so you don’t have regrets about the size of your home.

_____ Have you decided on the best location for your family?

Be clear on your location goals so that you don’t get emotionally persuaded into compromising on where you want to live. You can fix up, expand, renovate, and personalize many aspects of a house, but its location will never change — make sure you love it!

_____ Have you shopped around to find the best interest rates and lenders?

When it comes to interest rates, even a small fraction of a percent can hit your pocketbook hard. Be sure to compare rates on a site like Credible before choosing a lender!

4 Ways To Dramatically Reduce The Cost Of Your New Home

So far in this guide, we’ve covered a lot of information about how expensive it can be to buy a home.

In this section, we do the opposite. We’ll show you four ways to drastically reduce the price of your home, which can go a long way toward covering some of your home buying and homeownership expenses.

1. Find The Best Possible Interest Rate For Your Mortgage Loan

Comparing interest rates before you buy a home can save you hundreds every month, adding up to tens of thousands over the term of your loan.

For example, if you’re buying a $300,000 home on a 30-year fixed mortgage, and you stick to the standard payment plan:

- A 4.5% interest rate means you’ll pay about $1,520/month mortgage payments and a total of about $547,220 for your home.

- A 3.5% interest rate means you pay about $1,347/month mortgage payments and a total cost of $484,968 for your home.

In this example, a one percent difference in interest equals more than $60,000 over the lifetime of your mortgage.

Comparison sites such as Credible allow you to view current interest rates so that you can choose the lender with the lowest rates.

As part of your loan negotiations, ask the lender for a loan with no prepayment penalties and request a no-fee financing deal. These agreements allow you to pay off your home earlier without penalties and to also cut down closing costs.

2. Avoid Private Mortgage Insurance Fees

If you make a downpayment of less than 20% on your future home, you’ll likely get hit with PMI fees, which usually cost between .5% – 2% of the total price of your home.

Avoid the additional PMI fees by saving a 20% downpayment before you begin shopping for a home.

3. Negotiate A 7-day Contingency

When negotiating the price of a home with the seller, ask for a 7-day contingency as part of the deal.

The 7-day contingency allows you to back out of the deal, for any reason, within 7 days.

- Hire a private property inspector to immediately inspect the home for critical issues that might cost you money to fix. If they find any, you can back out of the deal or work the cost of repairs into your negotiations.

Negotiating a 7-day contingency is essential to thorough financial planning because it can help you avoid emergency repairs that may cost thousands of dollars during your first year of homeownership.

4. Make Bi-weekly Mortgage Payments

Instead of making one monthly mortgage payment, consider splitting the cost in half and making a half payment every other week.

This helps you make a few extra payments each year, and the savings over time is impressive.

For example, if your regular monthly mortgage payment is $764, pay $382 every other week instead.

For a $160,000 loan with 4% interest on a 30-year fixed mortgage, this strategy will save you $18,703 over the lifetime of your loan, AND you’ll pay it off two and half years early.

With a little understanding of how home buying works, you can save quite a bit of money when purchasing a new home.

To reduce your costs, find the best interest rates, avoid private mortgage insurance fees, negotiate a 7-day contingency, and make biweekly mortgage payments.

How To Buy Your First Home

When you’ve saved and budgeted everything necessary to purchase your first home, here are the steps you’ll take to buy it:

- Set your budget.

- Get ready to shop.

- Find a lender and get pre approved.

- Shop for your new home.

- Make an offer — understanding “escrow”

- Complete the closing process.

Step One: Set Your Budget

Once you understand the total costs of purchasing and owning a home (outlined in the sections above), you’re ready to begin budgeting for a home.

Pre-purchase Considerations For Buying A Home

Before you consider purchasing a home, you want to have the following financial points in order:

- 20% of the purchase price of your home saved for the down payment

- Six months of living expenses set aside for emergency savings

- Credit score of good or (preferably) very good

When you have the basics in place, you’re ready to consider whether you’re prepared for the monthly costs and purchase costs involved in buying and owning a home.

Purchase Costs Related to Buying A Home

When people shop for homes, they often focus on the overall purchase price and what their regular monthly mortgage payments will add up to.

In all the excitement, it’s easy to forget that there are significant purchase costs involved when purchasing a home, many of which are not covered by the mortgage loan.

Keep the following purchase-related expenses in mind when budgeting to buy a home:

- Closing costs (1.5% – 2.5% of total home purchase price), which are sometimes included in your mortgage loan. It’s better to pay for your closing costs up front so that you don’t have to pay interest on them by including them in your loan.

- Miscellaneous expenses (about $600 – $2,000) such as survey, appraisal, and inspection fees.

- One year of homeowner’s insurance (price varies depending on your home and its location). This expense is not included in your mortgage loan, so you must pay for it separately.

- Six months of property taxes, which vary by county and are due at closing.

- Financial reserves of 2 or more months (depending on lender) of mortgage payments in your account. You should be fine on this requirement if you already have your 6-month emergency savings accounts in place.

Next, you’ll take a look at your projected monthly expenses, to plan for the extra costs you’ll incur as a homeowner.

Homeownership Expenses

To ensure that you can afford a home, keep your monthly mortgage payments (including homeowners insurance and property taxes) to less than 27% of your net income.

Also keep in mind that if you’re planning on having children and one parent will stay home with them, you should budget based on one income instead of two.

In addition to mortgage, insurance, and tax payments, you’ll want to include the following expenses in your projected homeowner budget:

- Mortgage payments, homeowners insurance, and property taxes are typically lumped into one payment, especially during the early years of your mortgage. In most cases, you’ll make one monthly payment to an escrow company, and they turn around and make payments to the bank, insurance company, and government on your behalf.

- If you don’t make a down payment of at least 20% on your home, you can count on paying for your banker’s private mortgage insurance (PMI). PMI protects your bank should you default on your loan, however, it does absolutely nothing for you. PMI, which is typically folded into your monthly mortgage payments (along with insurance and taxes) is e-x-p-e-n-s-i-v-e. It typically costs between .5% – 2% of the total price of your home each year.

For example, if you purchase a $285,000 home, expect to pay about $285 extra (on top of your mortgage) every month. Hopefully, you save up for a downpayment of at least 20% on your home so you can avoid wasting a significant amount of money paying for your banker’s insurance. Otherwise, you’ll need to include this cost in your budget until you have 20% equity in your home.

- Maintenance costs run an average of .75% – 3% of your home’s value each year (depending on the age of your home).

- Utilities, which may cost more in a home than you pay in an apartment. Utilities include electricity and heat, so please be sure to budget for extreme weather highs and lows. Air conditioning and heat cost much more when the weather is extreme.

- Homeowner or condo association fees, which can rise over time.

- Seasonal services such as landscaping, snow removal, pool fees, cleaning, and other related expenses.

Buying a home involves three aspects of budgeting: Pre-purchase preparations, purchase costs, and homeownership expenses.

Once you’ve budgeted for homeownership and understand how much home you can afford, you’re ready to move on to the pre-approval process.

Step Two: Get Ready To Shop For A Home

Before you move on to the next steps of homebuying (finding a lender and getting pre-approved), you should be fully prepared to begin shopping for a new home immediately.

A bit of research can go a long way when shopping for homes, so consider the following before you secure a lender.

Research Real Estate Agents If You Plan To Work With One

At this point, you won’t be meeting with or hiring a real estate agent, but you should decide whether you’re going to use one and who you might consider working with.

Hiring a real estate buying agent is not required, but it is highly recommended.

PROS And CONS Of Hiring A Real Estate Agent When Shopping For A Home

PROS:

- It typically doesn’t cost you a dime to hire a buyer’s agent.

- A real estate agent saves you time and energy, since they know the market and can help you zero in on homes that are a good fit for you.

- An agent handles the real estate contact for you.

- A good agent knows how to properly present an offer so that it doesn’t get rejected due to missing information or poorly written language.

- An agent helps you manage offers, contingencies, inspections, and other deadlines.

- An agent has connections to every type of professional you need along the way. Whether it’s a contractor, inspector, attorney, or any other type of specialist, a good agent will provide you with solid recommendations for whomever you need on your team.

- A real estate buyer’s agent will help you negotiate pricing on your new home, and they will also understand when a home is overpriced. This helps you make appropriate home offers so that you neither overpay nor offend the seller.

- An agent will keep your schedule on track when it’s time to buy. This helps you avoid delayed closings and missed deadlines that can lead to significant problems when buying a home.

CONS:

- Potential conflicts of interest: It’s possible your agent may recommend a contractor or inspector in her network rather than one who is best for you.

- Risk of hiring a bad agent: an inexperienced or sloppy agent can cause major problems if they mishandle your contracts and paperwork

Overall, a real estate buyer’s agent can save you a great deal of time, money, and anxiety when purchasing a home.

If you decide to hire a real estate buyer’s agent when shopping for a home, do your research to find one with an outstanding reputation, personal recommendations, and excellent reviews.

Research Real Estate Attorneys If You Plan To Hire One

You’re not required to hire an attorney when buying a home.

A home is a large purchase, though, and a lawyer can grant you peace of mind by helping you navigate contracts and purchase terms, rather than entrusting the legal aspects to a real estate agent.

A real estate lawyer understands all aspects of the home buying process, and some people hire attorneys to help manage the contract as it develops with the real estate agent.

The lawyer can also advise you on other things such as potential lender delays that could affect your closing, inspections, and title search.

A home’s final contract includes dozens of pages of legal documents that can quickly overwhelm buyers (especially first-time homeowners), so you may want to consider hiring one to help you navigate the process.

If you’re purchasing a home in a different state, buying one through an estate sale, auction, or bank, or buying a home with structural or other major damage, you should always hire a lawyer to help with your home purchase.

If you’re a first-time homebuyer that’s not selling another property at the same time, hiring an attorney is optional — but will grant you an extra level of security and protection against errors and other potential problems.

If you do want to hire an attorney, this is a good time to ask around for recommendations on good attorneys.

Don’t look for the cheapest or most-promoted, flashy lawyers. Instead, check personal references, reviews, experience, and history when hiring a real estate attorney.

Research Homes In Your Area

Before you begin touring homes and talking to agents, do a bit of research on homes and locations in the area you’re interested in buying.

Go into your search with a good idea of what location you’d like to live in (perhaps even what neighborhood) based on prices, schools, traffic, commutes, and other factors that matter most to you.

Where you buy your home will have a significant impact on pricing and negotiations. The more you know in advance, the quicker and more effectively you’ll be able to shop for and negotiate on your new home.

Once you’ve done all your research and prepared your budget, you’re ready to find a lender and get pre-approved for your new home mortgage.

Step Three: Find A Lender And Get Pre-approved For Your Mortgage Loan

Once you’ve budgeted for homeownership and completed your pre-purchase research, the next step in home-buying is to find a mortgage lender and get pre-approved for a mortgage loan.

Determine What Type Of Mortgage Loan You’ll Choose

Mortgage loans come with several options, and determining your choices in advance helps you find a lender that offers the best rates for the type of loan you want.

The options you’ll choose from include the loan’s term, type of interest rate, and loan type.

- Loan term refers to how long you’ll take to repay the loan, and may be 30 years, 15 years, or another length of time. The loan term affects your monthly mortgage payments, the interest rate, and the overall cost (total interest) of your loan.We recommend a 30-year term because the lower payments will give you a bit of extra security, in case you face financial hardships in the future. Plus, you can slash the cost of your loan (interest) by making payments every other week instead of every month, or by doubling your monthly payments.

Longer-term loans are more expensive and typically come with higher interest rates.

Shorter-term loans are less expensive and typically come with lower interest rates.

- Interest rate type refers to whether you’ll take out a fixed-rate or adjustable-rate mortgage. We recommend a fixed-rate loan.

Fixed rate loans provide you with one interest rate that remains the same throughout the term of your loan. They are a bit higher but offer low risk and stability so that you can budget for and afford your loan.

Adjustable rate loans often provide lower interest rates in the beginning, but the rates change throughout the term of your loan. The fluctuations introduce complications, such as delayed interest payments, that can increase the balance on your loan. Additionally, adjustable rates mean that you can’t budget for one steady mortgage payment, since it can increase at any time.

- Loan type refers to whether you’ll take out a conventional, FHA, or speciality loan. Most loans are conventional, however there are other types of loans such as FHA and speciality loans that have been created by the government and lenders for people in unique situations.

Prepayment penalties are fees imposed when you pay your mortgage off earlier than agreed. Check with your lender to be sure your mortgage loan does not charge prepayment penalties.

Ideally, you would make half-payments on your mortgage every two weeks, to help you pay off your loan quicker and cut your overall interest costs significantly. To do this, you need a loan that doesn’t charge prepayment penalties.

When you’ve decided what term, interest type, and loan type you’ll apply for, you’re ready to choose a mortgage lender.

Choose A Mortgage Lender

When choosing a lender, your primary concern should be finding the lowest interest rates.

Not all lenders charge the same rates, so a bit of research can make a world of difference.

Rather than call around and talk to individual bankers (the old-fashioned way), you can use a mortgage rate comparison site to quickly determine who’s offering the lowest rates on mortgages.

Sites such as Bankrate, Smartasset, and Credible give you the chance to browse mortgage rates online after answering a few simple questions.

Some sites even allow you to get pre-qualified or pre-approved for a mortgage loan online.

Talk to lenders individually to learn what additional fees and costs are related to their mortgage loans. You may find that some offer additional savings at closing time, which could be a factor when choosing the best loan.

Secondly, the reputation of your lender is important. Do a bit of research to ensure that yours is experienced and reliable, so your papers don’t get lost or misfiled, which could lead to problems at closing time or even long-term credit problems.

Once you’ve chosen a mortgage lender, you’re ready for the next step: getting pre-approved for a mortgage loan.

Get A Pre-Approved Mortgage Letter

Getting a mortgage pre-approval letter from your lender makes it easier to buy a home.

The pre-approval letter lets you know exactly what you can afford.

It also may give you an edge in finding the best deals and properties, since many real estate agents are more willing to work with pre-approved buyers.

The term “mortgage pre-approval” is often confused with “mortgage prequalification,” so let’s start by understanding how the two processes are different.

- A mortgage prequalification is a casual process that gives you an idea of how much money you can afford to spend on a home.Prequalification is not a formal approval from a lender.

Prequalification is typically based on the information you give, plus a “soft credit” (less thorough) check.The advantages of prequalification are that 1) it’s an easy and quick process and 2) it helps you determine how much a lender might think you can afford to spend on a home.Get a prequalification when you’re wondering whether it’s time to begin shopping for a home. It can be a great help in determining what size home and mortgage you might be able to purchase.When you’re serious about buying, though, and ready to jump in the car and go look at homes, you’ll want to secure a mortgage pre-approval.

- A mortgage pre-approval is formal approval by a lender. To obtain a pre-approval, you submit documentation to verify that all the information you submit is correct. During the verification process, your lender will check your credit reports in a process known as a “hard” credit inquiry, which can affect your credit score by a few points.You should be 100% ready to walk out the door and start shopping for homes before you request a pre-approval from a lender.

Keep your finances steady from this point forward!

When buying a home, it’s critical to keep your finances steady throughout the homebuying process.

Try not to apply for any new credit, make any major purchases, or quit or switch jobs. Definitely don’t let yourself get behind on any payments!

Lenders check your credit score more than once throughout the process, and — Yes, you can be denied a mortgage loan even after closing (although it’s rare).

Any changes to your finances could also cause serious delays when it’s time to close on your mortgage loan.

Once you have your pre-approval letter in hand, you’re ready to begin shopping for a home and negotiating prices.

Step Four: Shop For Your Home

Now that you’ve budgeted, researched, found a lender, and obtained a pre-approval letter, you’re ready for the fun part: shopping for your new home.

This part goes much smoother if you have a real estate buyer’s agent because they can help coordinate home tours and negotiate a good price when you find the right home.

When you’ve found your new home and had your offer accepted, you’re ready for the next step: applying for the mortgage loan.

Step Five : Make An Offer — Understanding “Escrow”

When you find the home that you want and are ready to make an offer, your real estate agent will handle the negotiations.

Most offers include contingencies that must be met before the sale goes through, such as home inspection and appraisals, as well as your final mortgage loan approval.

At this time, a good faith deposit of typically 1-2% of the home price is usually put into an escrow account.

This escrow protects the seller in case the buyer backs out without just cause, and protects the buyer from handing over large amounts of cash before inspection and title verification are complete.

The money you put into the escrow account is usually applied to the down payment of your home when the purchase goes through.

You can back out of the deal if your contingencies aren’t met, however, the offer is a binding agreement once the terms of the deal are approved.

Once your offer is finalized, you move on to the closing process.

Step Six: Complete The Closing Process

Once you’ve found the home you want and had your offer accepted, the closing process begins.

A mortgage “closing,” the final step in homebuying, is when you sign the documents needed to purchase your home.

Your loan closing (if you take out a mortgage loan) and home closing usually happen at the same time.

Whether you all sit around a table inspecting documents or each signature is collected separately by mail or digitally depends on what state you live in.

Besides you, the buyer(s), there are several other parties that participate in closing:

- Your real estate agent, if you have one

- Title insurance company

- Escrow company

- Your real estate attorney, if you have one

- Seller’s real estate attorney

- Your lender

After closing, you are legally responsible for the mortgage loan on your new home.

Cash buyers can often close on a house within a couple days, but if you’re paying for your home with a mortgage loan, it takes longer.

Closing a mortgage, from the time you apply for your loan to the final signature, typically takes 45 – 60 days. The length of time it takes can be influenced by factors such as your credit score, employment history, and other factors tied to your finances.

The entire closing process includes:

- Schedule your home inspection. This process can take time, so you should schedule the home inspection right away to avoid delays in the closing process.

- Apply for your mortgage: Filling out your mortgage application should only take between 20 – 60 minutes, if you have the paperwork ready in advance.

- Submit your paperwork: The following documents are typically required to apply for a mortgage loan:

- Employment information (name, address, contact information) for the past two years

- Landlord contact information

- Bank, retirement, and investment account statements

- Proof of income (pay stubs or tax returns)

- Other documents as requested by your lender, such as business licenses, student loan deferment papers, and written explanations of any “atypical” deposits.

Additionally, your loan officer may request more paperwork to further document financial information related to your income, assets, debts, and employment. They may also require you to explain past situations such as bankruptcies, foreclosures, or other types of collection or delinquent accounts.

- Receive a loan estimate and conditional approval: You should receive a loan estimate that details the terms, conditions, and cost of your mortgage loan within three days of submitting your application.

- Appraisal: Your mortgage lender will order an appraisal once you sign and return your initial loan paperwork. Typically, you must pay for the appraisal before it can be scheduled.

- Lender review of home appraisal: Lenders review and check the appraisal when it comes in. Typically, lenders approve the appraisal. However, if the appraised value is much different than what the lender anticipated, they may schedule a second appraisal.

- Purchase homeowners insurance, which your lender will require before giving final approval on your loan.

- Loan processing and underwriting: Loan processors review all your information and compile it into an organized file for the underwriter. They order your credit report, verify your employment and bank deposits, order a property inspection (if required) and appraisal, and order a title search on your new property. Next, the loan processor passes your file along to an underwriter who will review and evaluate all your documentation and information.The underwriter is the person who makes the final decision on your mortgage loan, including whether you have the ability to repay the loan. Once your loan is approved, your interest rate is locked in at the bank's current interest rate.

- Prepare for closing day: To prepare for the final closing of your loan, make sure all your contingencies have been met and that title insurance has been ordered.Three days before your closing meeting, you should review the “closing disclosure,” which allows you to review the terms and details of your loan.

- Conduct a final walkthrough of your new home and property. You have a legal right to do a final walkthrough of your new property 24 hours before the final closing meeting. This walkthrough will help you verify that any repairs or other conditions have been made and met.

- Mortgage loan closing: As long as you’ve kept all your financial matters the same as they were when you applied for your loan, and didn’t quit your job or buy a new car or fall behind on any monthly payments, your loan closing should go smoothly.Bring two official forms of I.D. to your closing meeting (such as drivers license and passport), and be prepared to transfer the downpayment and closing costs to your banker. Expect to spend a couple hours in the meeting and walk out a brand new homeowner.

Closing on your loan and home is a complex process, but a good real estate agent or realtor can guide you through the process and keep you on schedule.

If you’ve never purchased a home before, we strongly recommend hiring a real estate agent to help ensure that your closing process goes smoothly.

Buying a home involves many steps, but if you understand the process and prepare for it in advance, the entire process becomes much easier, less stressful, and more enjoyable.

Beyond Purchasing Your First Home

Selling or refinancing your home are probably the last things on your mind when you purchase your first one, but it helps to have an idea of what might come next (even if it is far into the future).

Refinancing your home might be something you want to do, down the line, if you didn’t get the best interest rate on your mortgage.

When interest rates drop or when your credit score improves, you may be able to refinance your home to save money on your monthly payments and overall loan costs.

A mortgage refinance is when you take out a loan to pay off your original mortgage loan. Then, you make payments on the new loan at a lower interest rate.

You would refinance your mortgage in very much the same way you financed it — by shopping for the best rates and lenders, then going through an application process for the new loan.

Selling your home is probably hard to imagine when you first move in, but you never know when a job change or other life event might facilitate a cross-country move that requires you to sell your home.

When selling your home, you will go through a research and preparation process much like you did when you bought it. You’ll analyze the market to determine the best selling price and hire a realtor or real estate agent to represent and market your home.

Realtors or agents are not required, but by this point, you have a good idea how complex the process is, and you probably understand that hiring professionals to help you may be the most efficient and profitable way to approach selling your home.

Keeping yourself aware of current market prices, the value of your home, and the current interest rates will help you move more smoothly into refinancing or selling your home when the time comes.

Preparing To Buy Your First Home

When buying a home, preparation is the key to ensuring that you end up in a home you enjoy and can afford.

To understand whether you’re ready to buy a home, review the expenses and plan a homeowner’s budget.

Before you buy, you should save a 20% downpayment and enough money to cover closing costs, and you should also have a full emergency savings account in place.

Keeping your monthly mortgage payments to no more than 25% of your net monthly, and your entire spending budget to no more than 75% will help ensure that you can afford and enjoy your home for many years to come.

There are many ways to reduce the price of your home, but the two most important are strengthening your credit score and finding the lowest interest rates on your mortgage.

By fully understanding how much homes cost, preparing your budget for homeownership, and developing a clear vision of what you want, you can avoid homeowner regrets and enjoy your first home for many years to come.